Australia’s growth figures were released yesterday, with the revelation that the economy contracted by 0.5 per cent, in seasonally adjusted terms, over the September quarter. As a result, annual growth figures for the June quarter had also been revised down from the previous 3.1 per cent to 1.8 per cent. September’s figure is not only […]

Read Full Story‘Research’ Category

GDP contracts for the first time in five years

Posted date: December 8th 2016 . Author AdminSydney .

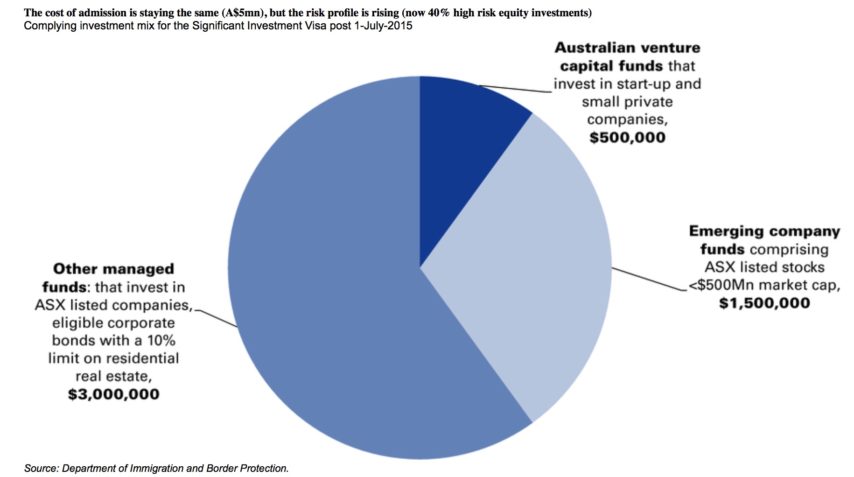

Changes to the Significant Investor Visa dramatically reduced application figures

Posted date: January 13th 2016 . Author AdminSydney .

The Significant Investor Visa (SIV) was introduced to attract high net worth investors into the Australian property market. We first reported on the SIV program in 2014, commenting that wealthy foreign investors, particularly Chinese investors, were using the SIV program to invest in the local Australian property market and live in the country. More recently […]

Read Full Story

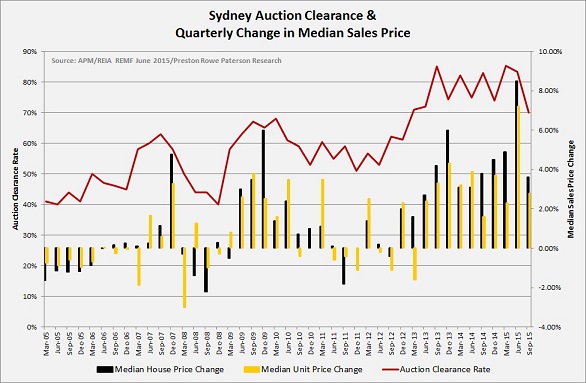

Auction rates & clearance rates throughout 2015

Posted date: January 11th 2016 . Author AdminSydney .

The Sydney residential market has once again made headlines, this time in regards to the falling auction clearance rates. In response to the reduction in rates, we’ve seen many news articles speculating the possibility of a bursting property bubble and a moderate growth outlook for 2016. The auction clearance rate is a number that describes […]

Read Full Story

The Daiwa Real Estate Appraisal Quarterly Research Report

Posted date: December 2nd 2015 . Author AdminSydney .

Daiwa Real Estate Appraisal, our Japanese partner, has released their quarterly research report on the property markets in Japan and Singapore. The detailed report provides comprehensive information on the residential and commercial markets including capitalisation rates, occupancy rates, rental rates and major transactions that have taken place throughout the period. The report can be viewed […]

Read Full Story

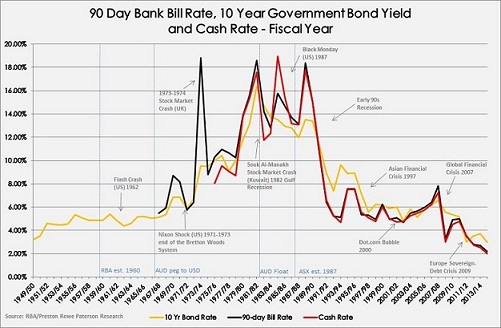

The risk-free rate – What does history tells us?

Posted date: July 24th 2015 . Author AdminSydney .

Interest rates are at historical lows as displayed in the chart below which considers the 10 year bond yield which is widely used and accepted as the risk-free rate. As the risk-free rate is widely accepted as the foundation to discount rate models, entities wishing to invest are finding it difficult to adjust their capital […]

Read Full Story