Tracking Yield and Discount Rate Compression

Posted date: November 2nd 2017 . Author Gregory Preston .

Preston Rowe Paterson Sydney is monitoring investment real estate yield and discount rate (IRR) compression. In the recent decreasing interest rate, environment yield and discount rate (or IRR) compression has become a commonly accepted phenomenon. What will be the impact of risk free rate and debt cost increases? Greg Preston, speaking at the Core Property Research Forum in Noosa, (read more)commented that whilst property capitalisation rates and internal rates of return (IRR’s) are often anecdotally related to long-term bond yields (10 year bond in Australia), to track capitalisation rate and IRR movement in the institutional investment real estate environment, more science needs to be applied to properly track expected property return movement.

He commented that entities buying and selling institutional real estate set investment hurdle discount rates using their Weighted Average Cost of Capital (WACC).

As a starting point the cost of capital considers the cost of equity using the Capital Asset Pricing Model (CAPM). The inputs to the CAPM equity pricing model include the 10 year bond yield, a market risk premium over the bond yield and the equity Beta of firms investing in real estate. Equity Betas of listed AREIT’s are published regularly and give guidance as to the markets interpretation of the volatility of stocks.

The debt side of the WACC calculation is considered in terms of a margin over prevailing bank bill swap rates and adjusting for corporate taxation. The ratio of the cost of Equity and Debt represents the WACC hurdle rate.

Preston Rowe Paterson Sydney has recently tracked the hurdle rate/discount rate (WACC) movement in a time series to look deeper into capitalisation rate and discount rate movement. Greg Preston commented that he acknowledges that a firm’s WACC sets a hurdle rate and that capital will be allocated to assets if total returns exceed the entity’s WACC, hence generating excess returns over the cost of capital.

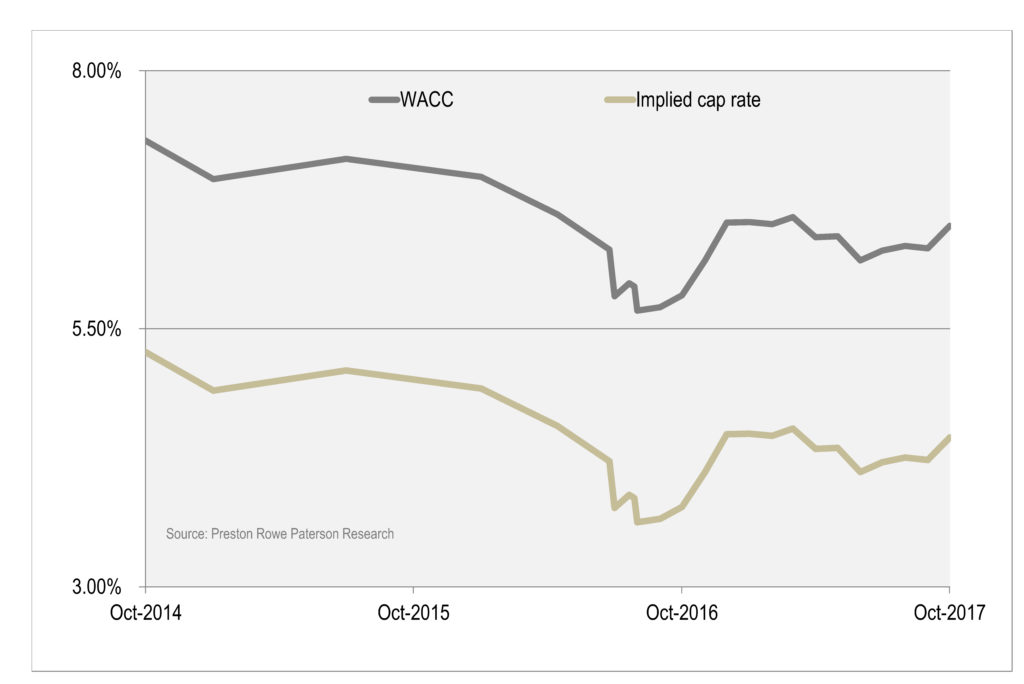

Using the 10 year bond rate, a static market risk premium of 6%, and an equity beta of 0.8 to 0.85 (as recently demonstrated by the AREIT market) it is possible to determine the cost of equity (CAPM); and the five year bank bill swap rate; tracking debt margins over swap rates; and assuming a 30% tax rate Preston Rowe Paterson Sydney has calculated a time series WACC.

Having established the WACC over time it is possible to then determine hurdle capitalisation rates by applying the Gordon Growth Model (developed in the 1960s by Professor Myron Gordon) to adjust the WACC based discount rate to a surrogate capitalisation rate. Greg Preston commented that it is also necessary to apply adjustment in an investment real estate setting for the need for ongoing capital expenditure. The chart below tracks capitalisation rate compression and discount rate (WACC) compression to the July through October low point in the market. It also shows the impact of slight movement in the risk free rate (10 year bond yield) as well as the cost of debt.

Obviously such analysis is fundamentally dependent upon the 10 year bond rate (risk free rate), equity betas of the entities buying and selling investment-grade real estate (AREITS) and expectations of market risk premium over the risk free rate to determine CAPM or the cost of equity. It is also fundamentally dependent upon the cost of debt and the ratio of debt to equity. In our recent analysis we have applied a debt to equity ratio ranging between 30 to 40% (debt) based on our understanding of gearing of listed funds at the date of preparation.

Given that interest rates (risk free rate and buy ambien online overnight the cost of debt) have moved upward slightly in recent times we may have seen a turnaround in this logic and perhaps a nearing of the end of the cap rate compression phenomenon, Greg Preston said. If the cost of capital is moving upward and the cost of debt is cheaper than equity, AREIT firms may choose to increase debt ratios to keep the cost of capital at an acceptable level to them.

Certain economists are forecasting increases in interest rates in the United States next year (2018) and, as history has shown, it is likely that interest rates in Australia will follow suit notwithstanding local economic circumstances and the Reserve Bank of Australia’s interest rate objectives/ initiatives.

Greg Preston commented that Preston Rowe Paterson Sydney will continue this time series based analysis to track institutional grade real estate investment discount rates in future Impressions.